With numerous selections and countless varieties of businesses out there, there is no a person-dimension-suits-all answer to the ideal financing option. To help you find the ideal loan for your needs, CNBC Decide on reviewed differing kinds of business loans and evaluated them on An array of options, including minimum amount and greatest loan quantities, time frame to repay the loan, personal credit rating rating required, Much better Business Bureau score and business prerequisites to use. (Go through more about our methodology underneath.)

These cookies help us to attract up anonymized data regarding the functionality of our digital apps. They allow us to improve the relevance, ergonomics, and functionality in the companies supplied on the web site.

We recognize the fast transforming opportunities and problems going through small businesses, and we are dedicated to attending to know you and The actual desires within your business.

It had been a snap renewing my finance with Ben at ICG Funding. His knowledge and dedication have constantly produced the process a lot less stress filled, And that i sincerely appreciate the wonderful experience.

We've a coronary heart for regional businesses through the entire Silver State and are able to assist yours thrive.

Ensure that you qualify. Critique your and also your business’s economic problem to grasp which loans you can obtain.

I'm managing them for The 1st time, and i am right away pleased with their expertise and dedication to customer contentment.

We are not an investment decision adviser, loan service provider, or even a broker and we do not give loans or home loans on to finish users, but only enables buyers to match with lending companions and more info platforms which will increase a loan. All loan approval conclusions and conditions are based on the loan vendors at some time within your software with them.

BestMoney steps user engagement according to the volume of clicks Every single shown brand acquired prior to now 7 days. The number of clicks to every brand is going to be calculated in opposition to other brands listed in the same question.

The moment resources are disbursed, business house owners can use 504 loan proceeds to finance preset assets that market business progress and position creation.

Study financing possibilities from $20k-$250k. We offer minimal and reasonable premiums, simple-to-fully grasp conditions and every month payments it is possible to afford to pay for. We'll work intently along with you to locate the loan which will accelerate your achievements and development.

File your software. The application process differs by lender and regardless of whether you look for funding on-line or in man or woman. You'll want to familiarize oneself with your lender’s approach beforehand.

When applying for an unsecured loan, business owners may well require to simply accept liability if they can’t repay the loan from the defined time-frame. This provision is recognized as a personal assure.

Demands change by lender, but businesses typically qualify for business loans based upon size, earnings, private and firm credit rating profiles, and just how long they’ve been running. They get financing as lump sums or credit score lines, dependant upon the variety of loan and lender.

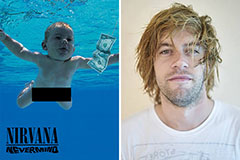

Spencer Elden Then & Now!

Spencer Elden Then & Now! Taran Noah Smith Then & Now!

Taran Noah Smith Then & Now! Katie Holmes Then & Now!

Katie Holmes Then & Now! Mackenzie Rosman Then & Now!

Mackenzie Rosman Then & Now! Megyn Kelly Then & Now!

Megyn Kelly Then & Now!